Sanctions in the modern specialty and reinsurance world

In recent years, the focus on sanctions has increased significantly in contemporary society. This has been prompted by various geopolitical developments, which have led to more an ever-increasing number of entities and individuals being covered by sanctions regimes, and subject to greater regulatory scrutiny. This regulatory strengthening, including an update to the Economic Crime Act (2022), has introduced penalties for organisations who breach these sanctions.

Events

Join Sanctions Compliance Forum

Participate in discussions, exchange insights, and build a strong community focused on Sanctions Compliance.

Join the EventNTT DATA's Sanctions Compliance Service

Utilising our proven expertise in technology-led insurance solutions, and combined with leading market technologies, NTT DATA have delivered an AI-powered end-to-end compliance solution for the Specialty and Reinsurance Market.

Our Sanctions Compliance Service automates the extraction, identification, and screening processes within a sanctions check, to improve our customers regulatory compliance. The service provides OFAC, OFAC Consolidated, EU and UK screening with options to include UBO, PEPs and Adverse Media screening.

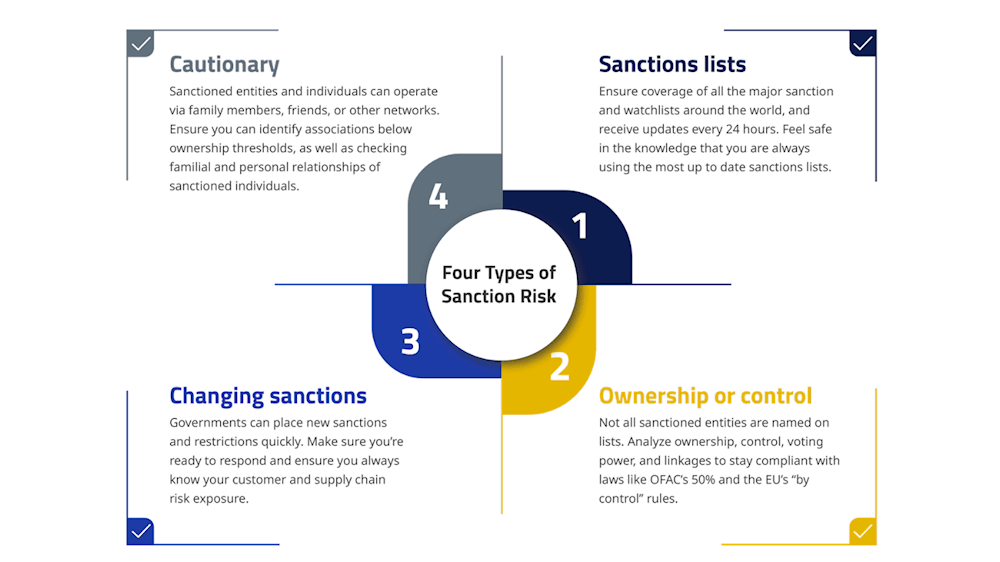

Managing your sanctions risk

Managing your sanctions risk as a business has never been so complex. Sanctions lists are constantly evolving with new entities being added and removed from lists across the world. The nature of these sanctions entities is changing to with targeted financial sanctions, trade embargoes, travel bans, narrative sanctions, sectoral sanctions, and human rights abuse sanctions all adding to a fluid, complex sanctions landscape for insurers to navigate.

Who needs to be screened and who screens?

At NTT DATA, we realise that these complex sanctions landscape makes life challenging for all participants within the Specialty market. It is worth noting that all under the current regulations all participants must conduct sanctions checks on any business that transitions through their business. Enforcement agencies can levy fines not just sanctions violations, but also for failure to have adequate controls in place. This means that firms must ensure they carry out effective sanctions screening operations, not only for direct insureds and reinsured but also for certain assets, associates, beneficial owners or controllers and potentially their extended supply chain.

Insurance

NTT DATA UK&I announces new Sanctions Compliance Service for Specialty and Reinsurance Market

Explore moreSanctions Insights

Key Facts

The amount of data elements our clients will need to address following our approach

Increase in accurate outcomes over previous process

faster than human-led process

Our Experts

Richard White

Head of Speciality Insurance, NTT DATA UK&I

Richard delivers transformational tech and BPO solutions, recently leading sales and customer engagement for the JV and London Markets modernisation.

Contact Richard

Anthony Croydon

Vice President, Insurance, NTT DATA UK&I

Senior Director Anthony has 35 years’ experience in the Londons Specialty and Reinsurance Market as both a practitioner and service provider.

Contact Anthony

Darren Temple

Vice President, Insurance, NTT DATA UK&I

For 25 years, Darren has offered tech-led solutions in financial services including Sanctions Compliance in the Specialty and Reinsurance Market.

Contact DarrenOur Insurance Services

CX and Digital Products

Customer Experiences

At NTT DATA, we focus on delivering experiences that drive employee engagement, boost customer loyalty and grow long term profitability.

Innovation & Strategic Investments

Innovation

At NTT DATA, we nurture the process of transforming ideas into something tangible and beneficial for our clients and society as whole, creating a vision for a sustainable future through technology.

Digital Transformation

NTT DATA can help businesses leverage technology and improve operational efficiency and enhancing customer experiences to stay competitive.

Edge

Emerging Technologies

NTT DATA leverages cutting-edge technologies and a highly skilled and experienced team to discover trends, envision the future and turn decision making into a competitive advantage.

Intelligent Automation

Intelligent Process Automation

NTT DATA, we solve client challenges in boosting business functions performance with a range of Intelligent Automation services, delivering automation that’s integrated across the enterprise.

Data and Analytics

Unleash the Power of Your Data

Our expertise cuts across almost everything we do for our clients, from data-enabled consulting and engineering modern data platforms to data-driven customer experience and data service management.

Cybersecurity

Cybersecurity Solutions

We work closely with our clients to understand their security needs and develop tailored security plans to address any risks and vulnerabilities.

Cloud

Cloud

To help you achieve your goals, we offer a wide range of cloud application and infrastructure consulting, system integration, architecture design and deployment services.

Latest Insurance Insights

Insurance

Insurtech Global Outlook 2023

A report from NTT DATA that examines the current and future situation of the insurance sector.

Discuss your Sanctions Compliance Service needs

One of our experts will be in touch