This year, I attended InsurTech insights 2023, a gathering of over 5,000 InsurTech professionals with more than 400 speakers. From the discussions, talks, and presentations that I took part in, there were four key points that I felt were worth reflecting on.

The main ideas were how we make AI trustable, the impact of computable contracts, customer-centric digital transformation, and minimising the risks when transitioning from legacy infrastructure. While these themes aren’t entirely new, I think they are key themes for the future of this industry, so let’s explore the topics being discussed by the best and brightest in our industry.

1. To effectively use AI, we must first build trust in its outputs

One of the most prominent themes this year was the development of AI-driven technologies. Specifically, how we must build enough trust in these systems before we can truly leverage them across the Insurance industry.

For a long time, we’ve had the data needed to train these models and make these processes worthwhile. Now, we have the technology as well. The challenge comes in bringing them together. Some of the most-touted questions were how we can prioritise explainability and manage the transition from legacy technologies to an AI-powered future – making sure at each step that people can learn to trust what the AI tells them.

In a sense, data is the new oil, and AI, depending on how it’s used, can be the extraction or refining process. If we want to optimise our automation or gain deeper insights from data we previously could not process (i.e. unstructured data sources like PDF broker submissions), we need to make sure people trust the systems that extract and then refine the data. To do this, both elements need to be accurate and retain the trust of the users.

AI needs a lot of data. In the specialty market (centred around high value but low volume), a key challenge to building trust is in getting enough use cases to train these models to a high standard. Without enough data, these models will be less accurate and, as a result, trust can be diluted.

From the discussions I was part of, three main steps emerged as guiding principles to help your AI adoption, these are:

- Ensure a smooth transition. Don’t try and go too far, too fast.

- Prioritise explainability. We must be able to explain how the AI got to its result.

- Put accuracy first. Even if this means including a ‘human in the loop’ while you’re training the system.

2. Computable contracts may be the future of InsurTech

In a fascinating panel discussion, we heard from experts like James Livett from LIIBA about Insurance 2.0 and the power of computable contracts. Computable contracts are one of the more exciting pieces of insurance technology to emerge in recent years.

By making contracts machine-readable, we can quickly understand the impact of insurance events, pay claims automatically, and speed up processing – along with a whole host of other benefits. However, to achieve these outcomes, we’ve got to go one step at a time.

The key is to start simple, perhaps beginning with numbers, as it’s a lot easier to get computers to understand figures than complex legal clauses. The next step might be tagging key parts of the contract, and then we can look at extending this to more complex parts of the contract like exceptions and liabilities.

By linking customer experience and data, computable contracts are likely to be at the centre of InsurTech’s future. This technology can promote transparency and prevent fraud: making the claims process more efficient, and enhancing the overall customer experience. Computable contracts are an exciting example of how we can modernise and automate some fundamental components of the insurance business.

3. Put the customer at the centre of any change programme and digital transformation

Quantifying the value of customer experience is an issue that’s been around ever since CX become fashionable – and that was no different this year. CX is a central part of everything that insurers do, but how do we prove its value at the highest level?

If we look at the example of Expedia and AirBnB, these are two companies in a similar field with global brand recognition. However, AirBnB has a higher multiplier due, in part, to its focus on CX resulting in a far more favourable cost ratio. In InsurTech, we need to take inspiration: measuring the impact of CX from an efficiency perspective and its outcomes on customer engagement and retention.

What we need is to build technology where customer experience has been considered from the outset to create engaged, ‘sticky’ customers who stay in the digital channel and create good word of mouth for your company – advocating for your services to other potential buyers.

To get this right, you need to make CX part of the DNA of your company. The main takeaways from InsurTech Insights were to make sure that your employees feel cared for, so that they can in turn take care of their clients; to make sure that the company lives its values; and to ensure that these values and culture match the brand you’re trying to portray.

4. Minimising the risks when transitioning from legacy IT infrastructure

This year, conversations were ongoing around the ‘build or buy’ choice, with the introduction of new technologies (especially in AI) resurfacing the pros and cons.

Building your own solution makes sense if it helps to solidify your USP or differentiate yourself. However, you need to be confident you have the capabilities to do it, as it can be a risky approach. If you don’t, that’s when you may need to seek expert partners.

To continue to be relevant in this market, modernising your legacy IT infrastructure is going to become a must. Many people are reluctant to move away from legacy systems, despite flagging performance, poor usability and maintenance issues. This is often due to legacy tech being entangled in a company’s ways of working and getting put into the ‘too hard’ or ‘too risky’ bucket by default.

Increasingly, however, modernising legacy IT infrastructure is becoming a competitive necessity. If you’re an insurance business that wants to derisk the decommissioning of your legacy core, here are some ideas that you might find useful.

The first step is to abstract the data from the legacy systems. Then, you can build an integration layer and use this to connect the data to a new digital front end. Over time, this will become the ‘single pane of glass’ that sits across your technology stack.

Using low-code can help accelerate this digital transformation, slowly moving functionality from the legacy core systems. This gets you to a point where you can make the decision to decommission the legacy core when the risk is much lower.

When insurance businesses can begin to transact their processes via this ‘single pane of glass’, we can reduce the inefficiencies associated with ‘swivel chair data entry’ from people switching between applications. It also allows you to move functionality from the legacy into a new ‘digital’ IT Operation where change is fast and agile. Over time, the business-critical functionality and data is abstracted from the legacy, reducing your reliance on it.

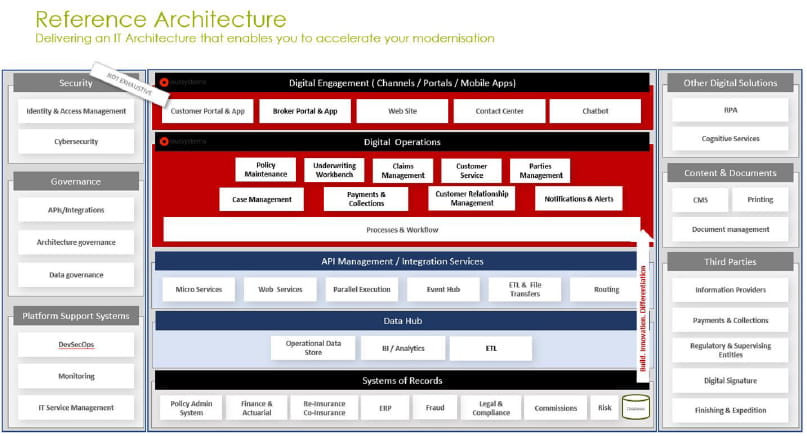

If you look at the below graphic, a proven reference architecture of NTT DATA, you can see how to deliver an IT ecosystem that enables you to accelerate your modernisation. One way that you can do this is through OutSystems’s low-code application development platform, which helps you to achieve business value quicker.

NTT DATA UK&I has decades of experience working with insurance businesses to modernise their technology stack and implement new capabilities. We’ve been an OutSystems partner since 2011 and are proud of our Global Systems Integrator status. If you want to see how we can help you with your digital transformation projects, get in touch with us today.