Those managing corporate supply chains have had a difficult few years with megatrends of transparency and resilience having a pervasive impact. Data and AI technology can help firms get on the front foot and establish greater control, saving significant costs and reputational damage.

Until recently, the data sharing agenda has been dominated by breaking down internal data silos. That’s still a challenge, but in the two years since I joined NTT DATA, the importance of sharing data across organisations has grown. It was highlighted in the UK’s National Data Strategy (see my response to that 1 and has been a theme across our government work (my blog Can I have a ‘P’ please, Boris? Critical Success factors for cross-government data sharing probably needs a title refresh 2). I come into contact with this problem most often in the supply chain through my work in carbon footprint measurement - purchased goods and services can represent anything up to 90% of emissions for some firms. Tackling the related issue of circularity in an abstract sense is like unpicking the supply chain in reverse.

However I’ve realised that there are two broader mega-themes emerging – both driving greater data sharing across the supply chain: transparency and resilience.

Drivers

Transparency in the supply chain is being driven by many factors in addition to emissions measurement including:

- Ethical sourcing

- Adherence to corporate policy

- Product safety

- Tariff and sanctions policy exposure

- Product recalls

- Cold chain assurance

- Regulatory assurance (e.g. in the defence sector)

- Reputational damage from counterfeit / grey market goods

Resilience drivers have become stronger since the pandemic, the war in Ukraine, and the Suez canal blockage. The supply chain impact has been highlighted by Resilinc 3. They found, for example, a secondary effect of the pandemic was an ‘high incidence of factory fires due to shortcuts in safety measures during pandemic lockdowns’ 4. 42% of respondents in a recent survey5 agreed that supply chains had become ‘too lean’ based on the experience of the pandemic. Risks to supply chain stability include:

- Logistics

- Environmental – climate change is bringing a greater incidence of natural disasters: one nation’s tragic flooding, hurricane or wild fire is another’s supply chain issue

- Geopolitical – need we say more

- Labour market shortage, turnover or unrest

The consequence of lack of resilience is both a delay in meeting customer orders and price shocks which are not backed off by customer contracts, leaving the firm in the middle of the supply chain an unwitting speculator against raw material costs. Compounding the problem, we also find the process of making a price change is complex for many customers.

Blockers

To address both drivers, greater data insights are needed across the supply chain – and preferably deep into it, but there are challenges including:

- Lack of standards

- Incompatible technology / APIs to obtain data

- Lack of digitalisation in some parts of the supply chain (an emailed PDF invoice does not count as digitalisation here)

- Data collection suffices for BAU but is not enough to tackle the wider challenge - or the opposite problem: so much potential data that could be useful that it’s not clear where to start

- Internal disconnects mentioned at the beginning – where operational data is not fed into analytical platforms – or insights are not fed back into automated decision-making. Famously Volvo needed to shift its surplus of green-coloured cars so devised a successful discounting strategy. However the production line team responded to the up-tick in demand by building more.

- Data sharing agreements and specialised data sharing needs

- Lack of understanding of the art of the possible in terms of automation and forecasting – or of the ability to see deeper into the supply chain and see suppliers’ suppliers (85% of disruptions happen deep in the supply chain6)

- Key decisions makers involved in fire fighting

- Concerns about giving away data that could be monetizable or conversely inflict damage through what could be inferred. (A different perspective is provided by the Open Data Institute who see data not as ‘oil’ to be traded but as infrastructure7 to allow the core business to operate more effectively)

- Lack of joined-up approaches

- Concern that inventory transparency will drive customers away

- Poor data quality

- Competing board priorities and consequently lack of budget to tackle the issues

Blockchain to the rescue?

Although NTT DATA have done pioneering work in blockchain (e.g. our Blocktrace solution for supply chain transparency) as a senior civil servant asked me: where has it been done at scale - outside of cryptocurrencies? Even Bitcoin only achieves 7 transactions per second. Also, blockchain is designed for situations where there are many actors, none of whom trust each other – but many supply chains are characterised by a small number of big players who do. No doubt there are adaptations of blockchain that can address needs in this area – for example achieving transparency within a limited community of interest, rather than making every transaction – or every aspect of the transaction - public. However, once you begin to centralise for performance, reduce the number of nodes to avoid wasted energy (the environmental curse of bitcoin mining) and reduce open data for confidentiality, it seems to me that there may be less complicated solutions out there. Moreover, while blockchain appears to do away with trust issues – because fraudulent transactions will not reach a consensus and history can’t be doctored - they cannot validate an assertion about the manufacture of a product: we still have to trust the manufacturer’s own process.

Broker model

Where a key player is able to offer a platform model to other parts of the supply chain, data sharing can work for all parts of the supply chain. We are working with a fresh food wholesaler who is effectively adopting a broker model – as the intermediary between farmers and supermarkets. We are designing a portal that requires standardised information from farmers but which then allows retailers and caterers to compare information on food provenance and standards. The short shelf-life of these products means the supply chain cannot get too complex, so this model is not suitable everywhere.

Other data sharing approaches

Other solutions offer a more holistic approach – covering internal data sharing (e.g. current inventory, IOT data, POS systems, master data, sales trends, warehouse data, production line capacity, logistics data, etc.) as well as external data sharing, open source data and licensed datasets. This ‘Control Tower’ of data is needed for establishing a supply chain strategy in the first place (e.g. where to site warehouses, mix of on-shore and off-shore suppliers), which is the speciality of my colleagues in NTT DATA’s Chainalytics group.

The datasets can then be augmented with exploitation capabilities such as AI and ML. Ideal characteristics are:

- Fresh data, since supply chains can be volatile and firms need to act quickly for example trading off stock availability vs price or respond to changes in supply and demand. The faster and more data-driven the process, the less the bullwhip effect of small changes at the end of the supply chain magnifying themselves through human hedging judgements and delays to major swings at the start of the supply chain.

- Cast the net wider than the goods being supplied to allow for halo and cannibalisation effects to be modelled

- Predict supply chain disruption, and in some cases prescribe a remediation as the start of an autonomous supply chain

- Understand the sensitivity of the final product cost to its different inputs to predict the effect of a price change in inputsStandardised attributes (e.g. ESG ratings) that allow suppliers to be compared and provide an unambiguous story for customers

Customers of this data asset go beyond supply assurance to logistics, fulfilment and forward inventory management.

The Snowflake difference

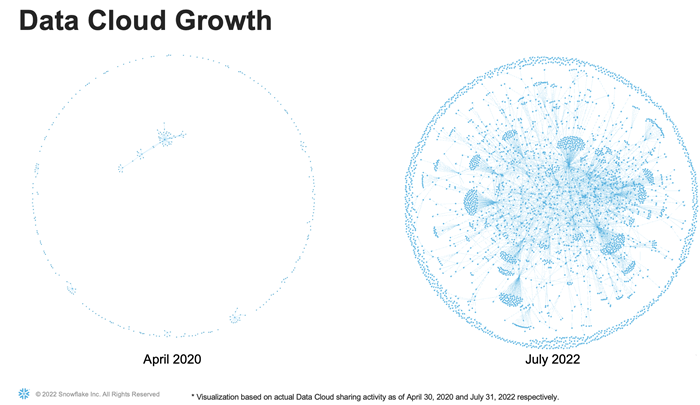

The growing capabilities of Snowflake’s cloud data platform solve some of these challenges. It provides multi-party data sharing without data having to be moved, so there is no danger of a stale picture. Each party can control of what is shared at a fine grain and it does not require both parties to be Snowflake users. The Snowflake data marketplace also provides easy access to data sources relevant to the supply chain such as the network of suppliers two or three steps back from those directly supplying the firm. Snowflake are in the unique position to measure the uptake in data sharing, although they can’t know how much of this is down to supply chain use cases. The picture below shows the growth of data shares in the last two years. As Snowflake partner’s this is exciting to see the uptake of this capability which has such an obvious application to the supply chain.

Eating the giant turkey

Given that the supply chain is an under-invested area, firms should start by using data to drive the basics – if your supply chain has a long tail, focus on the key suppliers. AI and ML are not needed on day one – especially if the historic data is patchy, there may not be enough data to train AI models. However, descriptive analytics provide immediate insights. Where does the turkey come in? It’s about getting the basics right. My career to date has been booked-ended by basic supermarket supply chain challenges. My first job out of university was looking after an EDI system for a hypermarket: it operated a simple one-in one-out rule for inventory management – when a single greeting card was purchased, another would be ordered in its place. Executing that transaction cost more than the card itself. Twenty years later, simple data quality was the challenge with a different retailer. The dimensions of a turkey SKU had the decimal point in the wrong place, so the automated logistics rostered a small lorry to deliver a single bird...

External links:

1 My response to the UK’s National Data Strategy here

2 My blog Can I have a ‘P’ please, Boris? Critical Success factors for cross-government data sharing probably needs a title refresh!

3 The supply chain impact highlighted by Resilinc

4 Secondary effect of the pandemic was an ‘high incidence of factory fires due to shortcuts in safety measures during pandemic lockdowns’

5 Supply chains had become ‘too lean’ in a recent survey

6 85% of disruptions happen deep in the supply chain

7 Open Data Institute see data not as ‘oil’ to be traded but as infrastructure