At a recent executive briefing, in which we brought together AI Experts and banking leaders in partnership with Armstrong Wolfe, we asked the question: why do so many banks find themselves stuck in cul-de-sacs on their AI journey?

For those who couldn’t join us, we’ve distilled the discussion into eight key themes that capture the challenges and opportunities ahead.

1. One-way systems

We often hear AI being described as a ‘tool’, or even a ‘servant’, but as David Fearne, NTT DATA’s Vice President of AI, correctly pointed out, that label makes it too easy to overlook the people giving the instructions: “AI is not failing people, people are failing AI,” he commented.

AI is capable of doing many things, but it’s often misused or poorly supported. At the end of the day, its outcomes are only ever as good as the data and systems built around it.

Recent headlines have raised questions about the ROI of AI projects. But as a researcher in the field, David suggested that focusing purely on capability overlooks the deeper issue of how people think about AI. Too often, it’s still viewed as something external to the team, rather than a collaborator within it. The technology itself is capable; it’s our mindset that needs to evolve.

How far that collaboration should go is still up for debate. It’s even been suggested that AI agents could fall under HR’s remit, with dedicated teams appointed to oversee their training, goals, and guardrails – just as they are for human colleagues. It’s an interesting idea, and one that could help make workforce planning more holistic.

2. The Control Room

One of the most thought-provoking questions raised during the discussion was: who really owns AI within the enterprise?

Most people at the briefing agreed that AI doesn’t sit comfortably within the IT department. While technology teams play a vital role in implementation, AI’s influence extends far beyond the boundaries of IT, touching everything from strategy and operations to people and culture. Several participants argued that AI’s “home” should therefore be elsewhere: within the strategy function or business transformation, where it has greater potential to holistically reshape how organisations work.

After much debate, the consensus was that AI is a cross-cutting capability that should serve the broader business. Deriving real value from AI requires reshaping the organisation root and branch: mapping existing processes, identifying what works, and, in some cases, rethinking or removing what doesn’t.

Right now, much of this work still falls to technology teams – and this can unintentionally skew AI adoption toward IT-focused use cases, rather than the broader business transformation it’s capable of driving. However, I’m willing to bet that this will be a short-term challenge. As AI becomes more deeply woven into everyday operations, the role of the Chief AI Officer will evolve or disappear as responsibility for AI spreads across the organisation. The same could be said for dedicated AI practices, as AI evolves from specialist capability to become part of how every team works.

3. The highway code

Debo De, our Global AI Banking Managing Director, spoke about the importance of governance and compliance: the rules of the road, so to speak. She emphasised that the most advanced banks are already adopting governance as code, meaning they’re embedding compliance directly into their development pipelines.

Throughout our discussion, it became clear that embedding governance into AI brings the best of both worlds: stronger compliance, and faster innovation. Creating an AI ‘highway code’ allows businesses to find a balance between control and innovation, reducing risk while building trust.

4. Motorways and bridleways

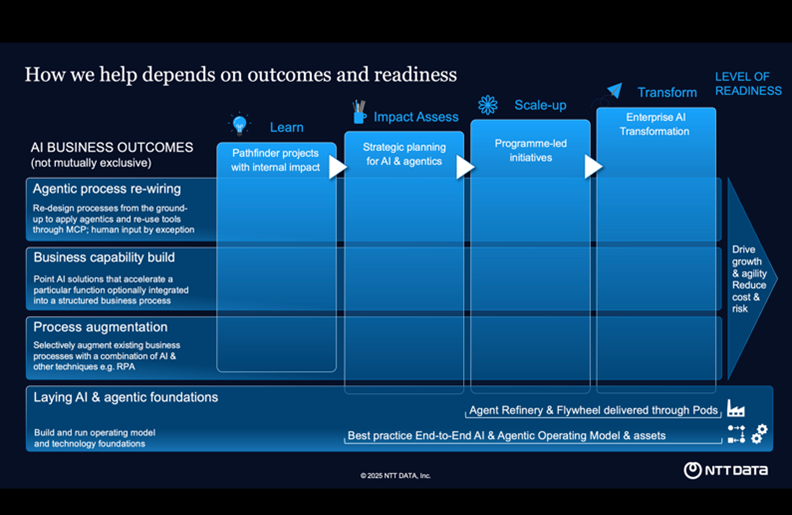

When it comes to AI adoption, not every organisation is travelling at the same speed or even on the same type of road. Some are cruising down the motorway, while others are still finding their footing on the bridleways. In my presentation, I shared four levels of ambition that capture where most businesses find themselves on this journey:

- Learning: many organisations start small, running “lighthouse” or “pathfinder” projects aimed at building internal understanding and proving value.

- Impact Assessing: others are exploring agentic AI. Our Agentic Jumpstart programme, for example, helps clients assess organisational maturity, map potential use cases, and design a technology blueprint.

- Scaling Up: this often happens as part of a wider change initiative, such as a major platform replacement or digital transformation programme.

- Transformation: we’re already working with one bank operating at this level, focused on large-scale cost reduction. Here, we’re examining key business processes across the organisation to evaluate where agentic AI can deliver the greatest impact.

Many of the banking leaders in the room said they were currently in the ‘scaling-up’ phase, though progress often varied across departments. Others questioned whether it might be wiser to pause and wait for the technology to mature. The challenge with that approach is that competitors aren’t standing still - organisations experimenting with AI today are building valuable capability and institutional learning. Even if you delay, you’ll still have to climb the same curve later – just from further behind. That said, for banks with a wide enough economic moat, a fast-follower strategy can still be viable option.

One participant asked whether AI might prove to be another overhyped technology, destined to fade like the metaverse or blockchain. While there’s plenty of hype around AI, the comparison couldn’t be further off. AI is already delivering real, measurable value across a broad range of use cases - something those earlier technologies never achieved.

Taking a step back, when asked how banking compares to other industries, Debo De noted that while some banks are highly advanced, overall the sector sits roughly on par with others. In my own experience, industries under heavier cost pressure have felt the need to move faster. Many have already restructured, and now need AI to deliver the efficiency gains that will sustain them over the long term.

5. The efficient route

Following this discussion, one audience member raised what many see as the elephant in the room: will AI’s efficiency gains will come at the cost of jobs?

David Fearne jokingly tried to ban the word “efficiency”, but his point was serious: AI should be used to drive growth, not just cost reduction. Most businesses, after all, would choose growth over cost reductions if given the chance. When applied in the right way, AI has the potential to preserve jobs by removing mundane tasks and freeing people to focus on higher-value work.

That said, I’m not entirely convinced by comparisons to the Industrial Revolution – during which job losses were vastly outweighed by new employment opportunities and rising average incomes. That technological revolution occurred at a much slower pace, providing the time required to retrain the workforce and absorb new generations into a changing economy. The pace of AI-driven change is far faster, and its impact is already being felt – particularly among entry-level white-collar roles.

The challenge now is to make sure the route to efficiency doesn’t come at the expense of opportunity. If organisations focus on using AI to amplify human capability rather than replace it, the gains in productivity can translate into sustainable growth. That, ultimately, is the more efficient route.

6. Changing priorities ahead

Moving on from the ambition of AI, we then explored its outcomes. One participant summed it up neatly as a question of ‘evolution versus revolution’. While many banks aspire to ‘transform,’ what that looks like in practice can vary widely depending on the outcome being pursued.

We’ve identified four broad areas that reflect the different ways organisations are approaching AI outcomes:

- Laying the AI & Agentic Foundations – principally the operating model and technology infrastructure. This includes a factory model to develop, release and monitor agents at scale. Based on conversations with our clients and partners, we think this covers around 10-20% of effort and investment in banks today.

- Process augmentation – adding AI to existing business processes, which are typically supported by established technologies such as Intelligent Automation. This is an ‘evolution’ approach: although the rewards might be lower than some other outcomes, the impacts are also fewer – for example impacts to compliance processes. The risks are also lower as a human is always in the loop. For this reason, we are seeing roughly 60-70% of effort in banks focused here.

- Business capability build – these AI initiatives are focused on a particular capability which is either cross-cutting or in a specific industry vertical. The emphasis is less on a particular business process and often applies to knowledge work. Many of our accelerators in NTT are in this space because they focus on a repeatable problem, but we estimate that only around15-25% of overall investment is going in this area, based on our conversations.

- Agentic process re-wiring – this is about replacing business processes with end-to-end agentic solutions where humans are involved by exception. This requires the right risk management approaches and technology maturity, so – contrary to the market hype – we are only seeing small amounts of practical activity at the moment.

- Agentic Process Rewiring – the most transformative stage, replacing end-to-end business processes with autonomous, agentic systems where humans intervene only by exception. This demands advanced risk management and technological maturity; so despite the market enthusiasm, real-world adoption is still limited.

The two dimensions of ambition and outcome form a grid that shows the different ways organisations can approach AI adoption. A bank might have a high level of ambition focused on a single outcome, or it might choose to learn across several.

This framework helps clarify how investment and effort are distributed today, and how those priorities may evolve as banks continue to build their AI capabilities.

7. Information super-highway

Many of the experts on stage came from a data background, so it’s no surprise that we all agreed on one point: getting the data foundations right is vital. More than once, I’ve heard the argument that fixing data should come before implementing AI; that we need to perfect how we manage and exploit data assets before we can truly benefit from AI. I understand that sentiment well; I’ve been tackling some of those data challenges for 25 years. But if we wait until every data issue is resolved before embracing AI, we may be waiting a very long time.

In reality, AI is helping to accelerate progress in data management. It’s going further than traditional data profiling, helping to catalogue information automatically and uncover gaps or weaknesses in data quality. My team, for example, is developing AI tools that can summarise how data flows are implemented and identify where recorded knowledge is incomplete.

We’re also seeing data management and knowledge management begin to converge, with knowledge increasingly layered above data to provide context and meaning. My team is focused on that intersection; we’re using technologies like knowledge graphs to connect and enrich both worlds.

8. The fast lane

Bank executives echoed a challenge we’re hearing across many industries: CEOs and non-executives are urging their organisations to move out of the slow lane on AI. In turn, IT and operations leaders are looking for reliable benchmarks to validate those ambitions and for a clear, practical route to delivering real value from AI.

Wherever your bank is on the ‘grid’ of outcomes and ambitions, we can help – reach out to me bill.m.wilson@nttdata.com or our UK banking CTO, Sumant Kumar (sumant.kumar@nttdata.com).

*Note: If you are in doubt about the terminology used in this article, please refer to our published AI Glossary.