According to research findings by NTT DATA, senior financial services executives overwhelmingly agree that implementing Artificial Intelligence (AI) will be the key competitive driver of success over the next few years. In fact, 83% agree that AI is creating new ways to differentiate offerings and win customers, driven by access to unique data sets; however, obstacles remain and adoption lags.

Respondents report technology implementation (55%), creating new business startup culture in an established business (51%), and organizational skill changes (43%) are all top AI challenges to implementing personalized proactive services. Despite these very real obstacles, financial institutions (FIs) must find a way to overcome them. Especially considering the COVID-19 pandemic, consumers are increasingly looking to digital finance solutions and apps that anticipate their needs and proactively offer financial guidance.

“A deeper eruption of AI in the main activities of financial institutions is a game-changer. As our study points out, data will allow these institutions to increase their competitiveness in the market as well as modernize their core business and improve the way services are offered to customers” said Josep Álvarez, Head of UK Banking Practice & BU at everis & NTT DATA UK. “This hyper-personalized use of data analysis, powered by AI, is a pathway the financial institution needs to take and ultimately provides a superior customer experience.”

According to recent data, there are several key findings that apply to financial institution businesses concerning the implementation of AI in their organizations:

The top challenges, in order, for FIs to attract and retain customers are the use of AI to provide customized advice to individual customers; build trust with customers; tackle competition from fintechs and technology companies; the limitation of in-person customer interactions; and the slow to launching of new products.

On the other hand, the majority of FIs see personalized proactive services as an opportunity to attract customers. However, only 16% of FIs are leveraging data to provide specific, one-to-one financial guidance to customers on how to achieve their life goals and ambitions. Also, only 32% of firms are leveraging data to provide “broad tailoring” — recommendations to target customer segments, as a one-to-many strategy.

The investment in personalized proactive services will deliver increased customer acquisition and retention for FIs, although it means facing several challenges in implantation, because it requires changes on the business side:

| Overall, the main drivers for FIs investing in personalized proactive services | Top AI challenges to implementing personalized proactive services |

| 68% customer acquisition | 55% technology |

| 66% customer retention | 51% creating new business startup culture in an established business |

| 61% new revenue channels | 43% organizational / skill changes |

| 59% enhanced emotional connection | 35% understanding the business questions to be answered |

| 58% expanded revenue in traditional channels | 35% management support |

| 53% increased profit margins | 30% building partnerships and alliances |

| 35% expanded customer wallet share | 30% data 22% justifying the ROI |

“The next step in creating the true digital bank of the future is a more powerful use of AI and other digital technologies to engage in the lives of each individual customer,” said Kaz Nishihata, Executive Vice President, NTT DATA. “Financial institutions across the globe will need to focus on AI, big data analytics and processing power — as well as make the organizational change initiatives and strategic partnerships — to meet the needs of customers and truly differentiate.”

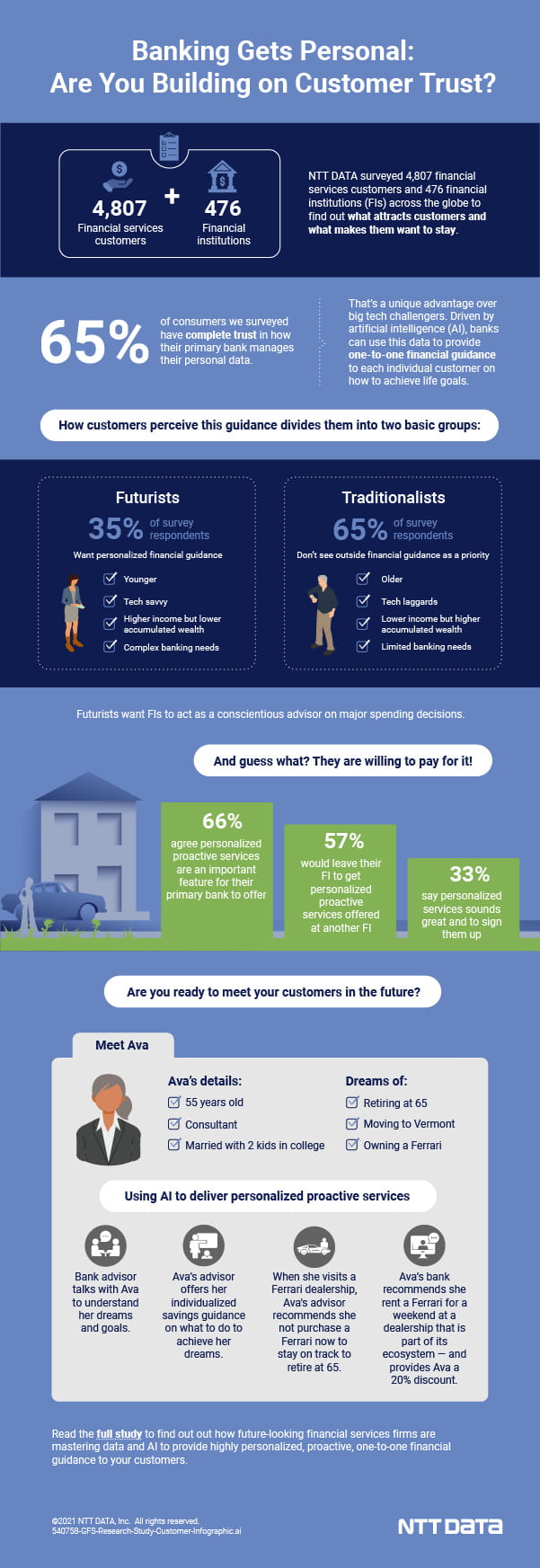

To explore how AI can enable FIs to attract and retain customers in a digital world, NTT DATA surveyed 4,807 consumers and 476 senior executives in banking, brokerage, capital markets, wealth management, and cards and payments across the U.S., UK, Germany, Spain, Italy, Japan, Brazil and Mexico in December 2020. To learn more about the consumer findings of the study, visit: NTT DATA Global Study Finds Nearly 50% of Customers Want Financial Institutions to Act as a Conscientious Advisor on Major Spending Decisions.